“What Factors to Consider When Buying Health Insurance”

Navigating the world of health insurance can feel overwhelming, but finding the right coverage is crucial for your peace of mind and financial security. As you consider your options, it’s important to focus on key factors that can make all the difference in your healthcare experience.

Imagine knowing that you and your loved ones are protected when you need it most. Imagine the relief of choosing a plan that fits your unique needs without breaking the bank. This article will guide you through the essentials, helping you make informed decisions that can save you time, stress, and money.

Dive in and discover how you can secure the best health insurance plan tailored just for you.

Types Of Health Insurance Plans

Choosing the right health insurance plan can be confusing. Understanding the different types of health insurance plans is crucial. It helps you select the best option for your needs. Each plan offers unique benefits and coverage. Read on to explore the various options.

Individual Plans

Individual plans cover one person. They are ideal for those who are self-employed or do not get insurance from their job. These plans offer flexibility. You can choose what works best for your health needs. Premiums may vary based on age and health history.

Family Plans

Family plans cover multiple family members. They provide comprehensive care for everyone in the household. These plans often come with discounts. This makes them cost-effective compared to buying individual plans for each member. Coverage includes doctor visits, emergency care, and more.

Group Plans

Group plans are usually offered by employers. They provide coverage to employees as a part of benefits. These plans often have lower premiums. The cost is shared between the employer and employee. Coverage under group plans is usually extensive, including preventive care and specialist visits.

Short-term Plans

Short-term plans provide temporary coverage. They are useful during transition periods. For example, when changing jobs or waiting for a permanent plan to start. These plans usually have limited coverage. They are not suitable for long-term health care needs.

Coverage Options

Choosing the right health insurance can be complex. It’s crucial to understand the coverage options available. Each plan offers different benefits. Knowing these can help you make an informed decision.

Inpatient Care

Inpatient care covers hospital stays. This includes surgeries and room charges. Check if the plan covers the hospital you prefer. Also, look for the duration of coverage. Some plans limit the number of days.

Outpatient Care

Outpatient care includes doctor visits and tests. It’s for treatments that don’t need a hospital stay. Ensure your plan covers specialist visits. This can save you money on frequent consultations.

Prescription Drugs

Prescription drug coverage is vital. It helps reduce medicine costs. Check if your regular medications are covered. Some plans have a list of approved drugs.

Preventive Services

Preventive services focus on early detection. They include vaccinations and screenings. These services can prevent serious illnesses. Ensure your plan includes these benefits.

Network Of Providers

Choosing a health insurance plan can feel overwhelming. One crucial factor is the network of providers. This refers to the doctors and hospitals connected to your plan. Choosing a network impacts your healthcare access and costs. Different plans offer varied networks. Understanding these can help make an informed choice.

Preferred Provider Organization (ppo)

PPO plans offer flexibility. You can see any doctor. In-network providers cost less. Out-of-network care is available too. But, it often costs more. PPOs suit those who want freedom to choose healthcare providers.

Health Maintenance Organization (hmo)

HMO plans require choosing a primary care doctor. This doctor coordinates your care. Referrals are needed for specialists. These plans often have lower premiums. HMOs are good for those who prefer structured care networks.

Exclusive Provider Organization (epo)

EPO plans combine aspects of PPOs and HMOs. They offer a network of providers. Care outside the network usually isn’t covered. They don’t need referrals for specialists. EPOs are ideal if you want in-network care without referrals.

Point Of Service (pos)

POS plans blend elements of HMOs and PPOs. You select a primary care doctor. Referrals are needed for specialists. These plans cover out-of-network care at higher costs. POS plans suit those wanting network flexibility and a primary doctor.

Credit: www.etmoney.com

Cost Considerations

Choosing health insurance is a big decision. One key factor is cost. Understanding cost helps in selecting the right plan. Several components affect the overall cost of health insurance.

Premiums

Premiums are what you pay monthly for health insurance. This payment is necessary to keep your coverage active. Lower premiums might seem attractive. But they can lead to higher costs later. Always balance premiums with other costs.

Deductibles

Deductibles are the amount paid before insurance covers expenses. Plans with high deductibles often have lower premiums. But you pay more upfront for medical care. Low deductible plans help minimize initial costs. Consider your medical needs when choosing deductibles.

Co-payments

Co-payments are fixed amounts for specific services. This can be a doctor visit or prescription. Co-payments make healthcare costs predictable. Smaller co-payments might be beneficial for frequent doctor visits. Review what services require co-payments in your plan.

Out-of-pocket Maximums

Out-of-pocket maximums limit total spending on healthcare. Once reached, the insurance pays 100% for covered services. This is crucial for managing unexpected medical expenses. High out-of-pocket maximums may lead to financial strain. Ensure your plan offers a reasonable maximum.

Policy Terms And Conditions

Understanding the policy terms and conditions is crucial when buying health insurance. These terms define what your policy covers and what it doesn’t. They help you know your rights and obligations. Without this knowledge, you may face surprises during claims. Carefully reviewing the terms ensures you choose the right plan. Let’s dive into key components like waiting periods, coverage limits, and exclusions.

Waiting Periods

Waiting periods refer to the time before certain benefits start. During this time, some treatments or conditions aren’t covered. Commonly, pre-existing conditions have a waiting period. It can range from a few months to a few years. Knowing this helps avoid unexpected out-of-pocket expenses. Make sure the waiting period aligns with your health needs.

Coverage Limits

Coverage limits are the maximum amount your insurer will pay. They apply to specific treatments or services. Some policies have annual or lifetime limits. Knowing these limits helps manage your healthcare costs. Choose a plan with limits that meet your potential expenses. This ensures you aren’t caught off guard by uncovered costs.

Exclusions

Exclusions are treatments or services not covered by your insurance. Common exclusions include cosmetic surgery or alternative therapies. Being aware of these helps you understand your coverage scope. It prevents unexpected costs for services not covered. Review the exclusions list before finalizing your plan choice. This ensures your policy meets your healthcare expectations.

Credit: juxgold.com.au

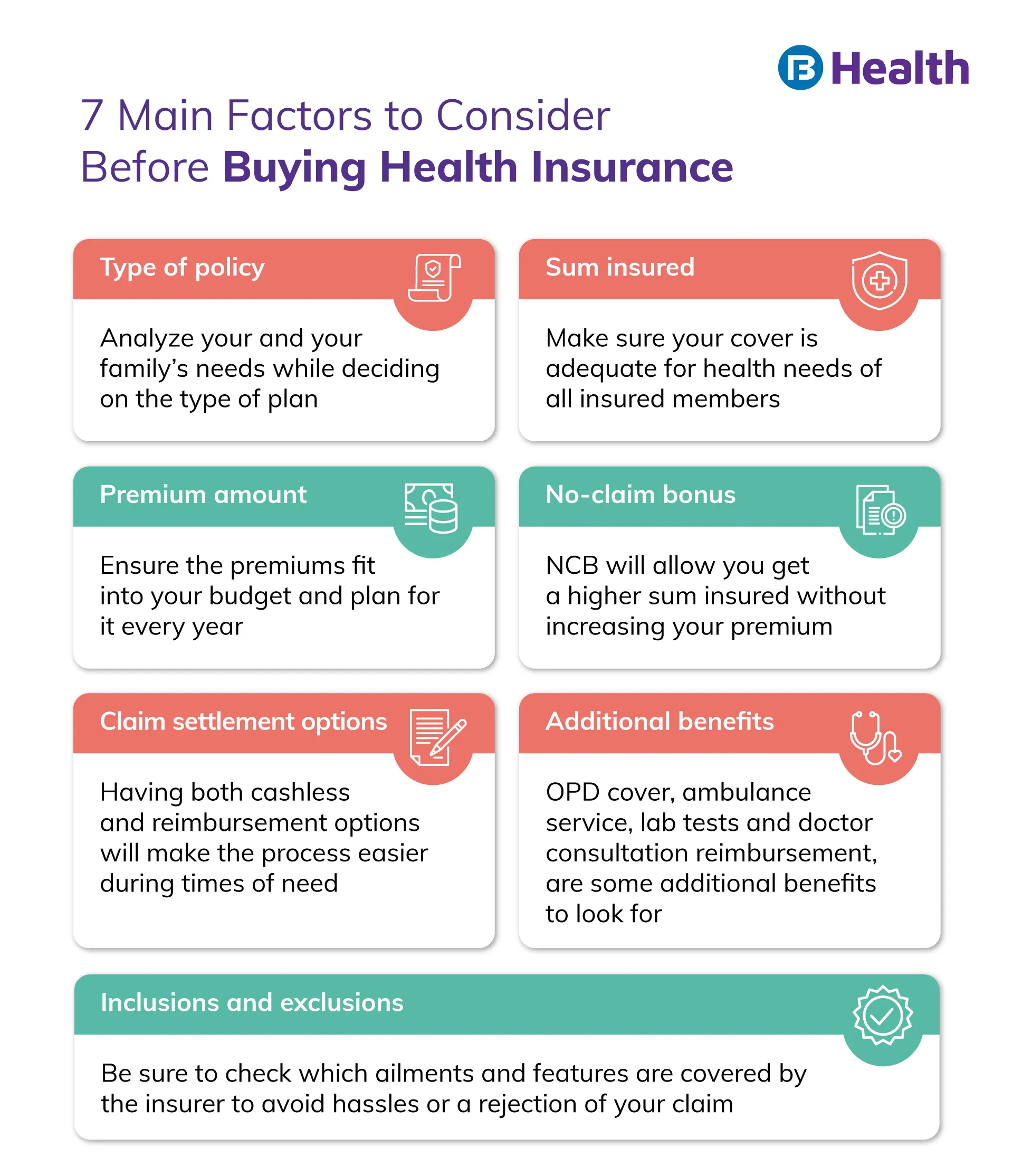

Additional Benefits

Choosing the right health insurance requires more than just cost and coverage. Additional benefits can greatly enhance your health care experience. These extras offer more comprehensive care and cater to specific needs. Understanding these benefits ensures you get the most out of your plan.

Dental And Vision

Dental and vision benefits cover regular check-ups and treatments. Dental care includes cleanings, fillings, and sometimes orthodontics. Vision benefits cover eye exams and glasses or contact lenses. These benefits help maintain your overall health and prevent future issues.

Mental Health Services

Mental health services are crucial for emotional well-being. Health insurance often includes therapy sessions and medication management. Access to mental health care can improve your quality of life. Choose a plan that supports your mental health needs.

Alternative Therapies

Alternative therapies offer unique approaches to wellness. These may include acupuncture, chiropractic care, or massage therapy. Such therapies can complement traditional medicine. They provide holistic care options for your health journey.

Choosing The Right Insurer

Choosing the right insurer is crucial in securing your health insurance. It impacts your peace of mind and financial stability. The right insurer provides reliable support and timely assistance. Consider the insurer’s financial health, customer service, and claims process. These factors will influence your overall experience and satisfaction.

Financial Stability

An insurer’s financial stability is essential. It ensures they can pay your claims promptly. Check their ratings from reputable agencies. Strong ratings suggest they can meet future obligations. Avoid insurers with low or unstable ratings. Financially stable companies offer a sense of security. You can trust them to be there when needed.

Customer Service

Good customer service is vital for an insurer. It ensures your queries and concerns are handled efficiently. Evaluate their responsiveness and availability. Look for insurers with 24/7 support. Read reviews from other policyholders. Positive feedback indicates reliable service. Helpful and friendly staff make a difference.

Claims Process

The claims process should be straightforward. A simple process saves time and stress. Check the average time for claim approval. Quick approvals show efficiency. Understand the documentation required. Minimal paperwork indicates a smooth process. An insurer with a clear process is preferable. It ensures you receive timely assistance.

Credit: www.jmbfinmgrs.com

Evaluating Your Health Needs

Choosing the right health insurance starts with understanding your health needs. Everyone’s health profile is unique. By evaluating your health needs, you can make informed choices. Consider various factors that affect your health. This ensures that your insurance plan covers what you truly need.

Chronic Conditions

Do you have chronic conditions? Conditions like diabetes or asthma require constant care. Health insurance must cover your regular treatments and medications. Check if the plan includes specialists for your condition. This ensures you receive necessary care without extra costs.

Family Health History

Your family’s health history can influence your health needs. If heart disease is common in your family, consider plans that cover cardiology. Being aware of potential genetic risks helps in selecting suitable coverage. It prepares you for future health challenges.

Lifestyle Considerations

Your lifestyle impacts your health insurance needs. Active individuals might need coverage for sports injuries. Smokers may face higher health risks, needing comprehensive plans. Evaluate how your daily habits affect your health. This helps in choosing a plan that aligns with your lifestyle.

Legal And Regulatory Factors

Choosing health insurance involves understanding legal and regulatory factors. These factors ensure your rights and protections. Knowing them helps you make informed decisions. They guide how insurance companies operate. This section explores key legal areas affecting your choices.

State Regulations

Each state has its own health insurance rules. These rules influence what plans are available. They set standards for coverage and pricing. States may offer extra protections beyond federal laws. Understanding your state’s regulations is crucial. It affects how insurance meets your needs.

Federal Mandates

Federal mandates impact health insurance nationwide. They ensure minimum coverage standards. These laws address essential health benefits. They include preventive services and emergency care. Federal mandates aim to provide fair access to healthcare. Knowing these mandates helps in selecting compliant plans.

Consumer Protections

Consumer protections safeguard your interests in health insurance. They prevent unfair practices by insurers. Protections include clear information about policies. They offer rights to appeal denied claims. Consumer laws ensure transparency and fairness. Understanding these protections empowers you as a policyholder.

Frequently Asked Questions

What Is The Importance Of Coverage Options?

Coverage options determine what medical expenses your policy will pay. It’s crucial to choose options that match your healthcare needs. Comprehensive coverage can protect you from high out-of-pocket costs during emergencies or routine care. Always review policy details to ensure you have the necessary coverage.

How Does Premium Affect Your Budget?

Premiums are the regular payments you make for your health insurance. High premiums might strain your budget, while lower premiums might mean higher out-of-pocket costs. Balancing premium costs with coverage needs is essential. Consider your financial situation and healthcare requirements when choosing a premium.

Why Consider The Network Of Providers?

The network consists of healthcare providers covered by your insurance. Choosing an insurer with a wide network ensures you have access to preferred doctors and hospitals. Limited networks might restrict your choices or lead to higher costs. Verify the network details to avoid inconvenience.

What Role Do Deductibles Play In Insurance?

Deductibles are the amount you pay before insurance covers expenses. Higher deductibles often mean lower premiums but can lead to higher initial costs. Understanding your deductible helps you plan for potential healthcare expenses. Choose a deductible that aligns with your financial capacity and health needs.

Conclusion

Choosing health insurance requires thoughtful consideration. Focus on your needs and budget. Compare plans for best coverage. Check for included benefits and services. Read the fine print carefully. Avoid surprises later. Consider network hospitals and doctors. Ensure your preferred ones are covered.

Evaluate premium costs and deductibles. Balance them with coverage benefits. Don’t rush the decision. Research thoroughly to find the right fit. Ask questions if confused. Use online resources for more information. It’s important to make an informed choice. Your health and finances depend on it.

Choose wisely and stay protected.

“As the voice behind Radiant Glow Health, we are dedicated to being your ultimate wellness and vitality companion. Our mission is to inspire and guide you on your journey to a healthier and more vibrant life. Join us as we explore holistic health practices and empower you to radiate wellness from within.”