Understanding what your health insurance covers can feel like deciphering a secret code, especially when it comes to therapy. You might wonder, “Will my insurance help me with therapy costs?”

Or “What steps should I take to find out? ” These questions can leave you feeling uncertain and overwhelmed. But what if you had the clarity and confidence to navigate this maze with ease? Knowing whether your health insurance covers therapy isn’t just a financial concern—it’s a vital step towards taking care of your mental well-being.

We’ll guide you through the process, empowering you with the knowledge you need to make informed decisions about your mental health care. Let’s dive in and unveil the answers you’ve been seeking.

Checking Your Health Insurance Policy

Understanding if your health insurance covers therapy is crucial for well-being. To find out, start by checking your health insurance policy thoroughly. This document holds essential information about what is included and what is not. Knowing how to navigate your policy can save you money and ensure you get the care you need.

Key Terms To Look For

When reviewing your policy, focus on specific terms. Words like “mental health,” “behavioral health,” and “psychotherapy” are important. These indicate therapy-related services. Also, check for “in-network” and “out-of-network” coverage. These terms affect where you can receive therapy and how much it will cost.

Coverage Limits And Exclusions

Policies often have coverage limits. This means there’s a cap on sessions or cost. Know these limits to avoid unexpected expenses. Exclusions are services not covered by your plan. They might include certain types of therapy or specialists. Understanding exclusions helps in planning your therapy visits effectively.

Credit: www.coveredca.com

Contacting Your Insurance Provider

Discover if your health insurance covers therapy by checking your policy details. Call your provider for clarification. They can explain coverage options, limits, and any necessary referrals.

When it comes to understanding whether your health insurance covers therapy, reaching out directly to your insurance provider is a crucial step. This may seem daunting, but it’s essential for getting clear information. Consider it a proactive move towards taking charge of your mental well-being.

Questions To Ask

Before you call, jot down specific questions. Ask whether therapy sessions are covered under your current plan. Check if there are any limitations on the type of therapy or the number of sessions. Inquire about the need for a referral from your primary care doctor. This could be a key step in ensuring your therapy is covered. Also, check if you need to choose from a network of approved therapists.

Clarifying Coverage Details

Once you have your questions ready, get in touch with your insurance provider’s customer service. Politely ask them to explain your benefits in simple terms. You want to understand your coverage clearly without the insurance jargon. Ask for documentation or a summary of benefits if available. Having it in writing can be helpful for future reference. Discuss any co-pays, deductibles, or out-of-pocket costs related to therapy sessions. Remember, insurance policies can be confusing, but don’t hesitate to ask for clarification if something isn’t clear. Your health is too important to leave any details uncertain. By taking these steps, you’re ensuring that you make the most of the benefits available to you.

Exploring Different Types Of Therapy

Exploring different types of therapy is essential in understanding your health insurance coverage. Therapy can help with emotional, mental, and psychological well-being. Knowing what types of therapy your insurance covers can save you time and money. It’s crucial to understand the difference between in-network and out-of-network providers. Also, grasping the types of therapy covered by your plan is vital.

In-network Vs. Out-of-network Providers

In-network providers usually cost less. They have agreements with your insurance. Out-of-network providers might be more expensive. Your insurance may cover less with them. Check your insurance plan for details. Find out which providers are in-network. This knowledge can help you make informed choices.

Types Of Therapy Covered

Many insurance plans cover different therapies. Common types include cognitive behavioral therapy and psychotherapy. Some plans may include group therapy. Coverage can vary widely. Review your insurance documents. They will list the therapies covered. Ask your insurance company if unsure. Understanding coverage can prevent unexpected costs.

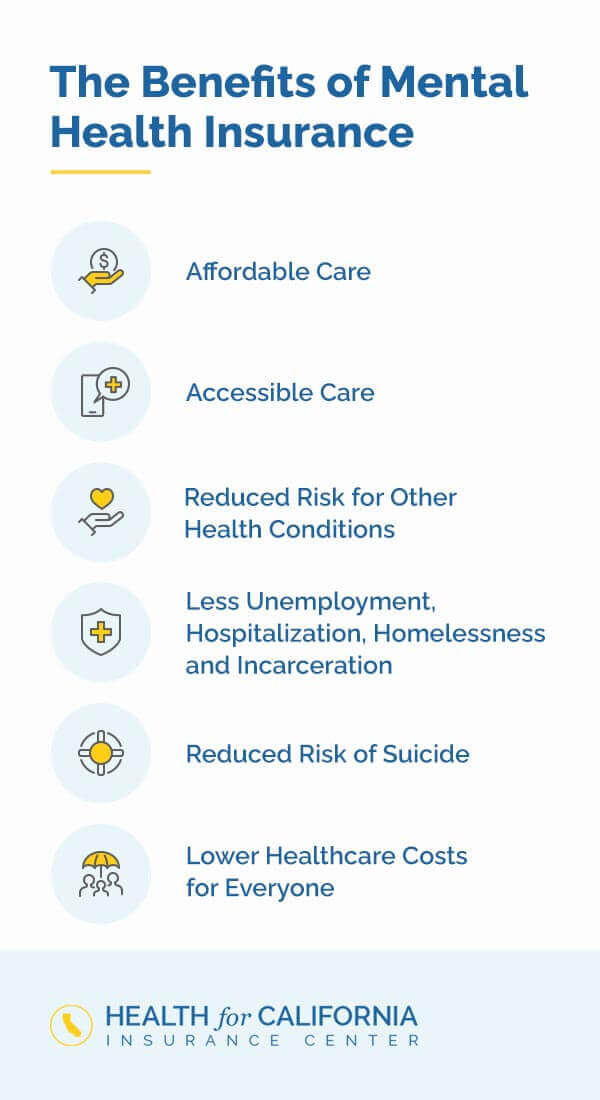

Credit: www.healthforcalifornia.com

Understanding Copays And Deductibles

Understanding copays and deductibles is essential for managing therapy costs. These terms can seem confusing, but they play a key role in your health insurance plan. Knowing how they work will help you plan your therapy expenses better.

How Copays Work

Copays are fixed amounts you pay for therapy sessions. Your insurance covers the rest. This fee varies based on your plan. You might pay $20 per visit. Some plans have no copay for therapy. Check your policy details to know your specific copay amount.

Impact Of Deductibles On Therapy Costs

Deductibles are amounts you pay before insurance kicks in. Once met, insurance covers most therapy costs. Some plans have high deductibles. In these cases, you pay more out-of-pocket initially. After reaching the deductible, your costs decrease.

Understanding your deductible is crucial. It directly affects your therapy expenses. Contact your insurer to clarify your plan’s deductible. This helps you budget effectively for therapy sessions.

Navigating Pre-authorization Requirements

Understanding if your health insurance covers therapy can be tricky. Check your policy details or contact your insurer. They can provide specific information on pre-authorization requirements and coverage. Knowing this ensures you avoid unexpected costs and get the support you need.

Navigating the pre-authorization requirements for therapy coverage can be daunting. Health insurance often requires pre-authorization to ensure the treatment is necessary. This step is crucial in determining whether your insurance will cover therapy sessions. Understanding these requirements helps avoid unexpected costs and ensures a smooth process. It’s important to know the steps involved and potential challenges.

Steps To Obtain Pre-authorization

Start by reviewing your insurance policy documents. Look for specific guidelines on therapy coverage. Contact your insurance provider directly. Ask them about the pre-authorization process. They may require forms or documentation from your therapist. Ensure your therapist is within the network. Network providers are often covered more thoroughly. Submit all required documents promptly. Delays can lead to coverage issues. Keep track of any deadlines or specific instructions. Follow up with your insurer to confirm receipt of documents.

Common Challenges And Solutions

Sometimes the pre-authorization process is complex. Miscommunication between insurers and therapists can occur. Double-check all information for accuracy. If denied, understand the reason behind it. Appeal the decision if necessary. Provide additional documentation or clarification. Ensure your therapist supports you in this process. Another common issue is coverage limits. Verify the number of therapy sessions covered. Plan your therapy schedule accordingly. If coverage is limited, explore supplementary options. Some organizations offer sliding scale fees. These can help manage costs.

Utilizing Online Resources

Utilizing online resources simplifies the process of checking your health insurance coverage for therapy. The internet offers a wealth of information at your fingertips. You can easily find out what your policy covers. This saves you time and effort. It also provides peace of mind.

Online tools and resources are easily accessible. They are user-friendly and designed to help. By using them, you can make informed decisions about your therapy needs. Here’s how you can effectively use these resources:

Insurance Company Websites

Insurance company websites are a primary resource. They often have a dedicated section for policyholders. Here, you can log in to view your benefits. This includes coverage details for therapy services. Most sites have a search feature. Use it to find specific information quickly. Reading FAQs can answer common questions. Always keep your policy number handy. It helps when searching for specific coverage details.

Third-party Tools And Apps

Third-party tools and apps offer additional support. They provide an easier way to understand your insurance coverage. Many apps allow you to input your policy details. They then outline your coverage for therapy. Some tools compare policies. This helps you see how your coverage stacks up. Many apps are free. They are available for download on smartphones. Using them can save you time and reduce confusion.

Seeking Help From Hr Or Benefits Coordinator

Wondering if your health insurance covers therapy? Reach out to your HR or Benefits Coordinator. They can provide specific details about your plan’s coverage and guide you through any necessary steps to access mental health services.

Seeking help from your HR or Benefits Coordinator can be a smart move when you’re unsure if your health insurance covers therapy. This approach can save you time and frustration, especially if you’ve been hitting dead ends trying to decipher insurance jargon on your own. Let’s explore how these roles can assist you in understanding your coverage better.

Role Of Hr In Insurance Queries

Your Human Resources (HR) department is a valuable resource. They’re there to help navigate the complexities of your health insurance plan. If therapy coverage is unclear, asking HR can provide clarity. HR professionals often have a broad understanding of the benefits package. They can explain what your specific plan covers and any steps needed to access therapy services. Don’t hesitate to reach out and ask detailed questions. Sometimes, speaking directly to HR can reveal hidden benefits or options you weren’t aware of. Have you considered that there might be supplementary programs supporting mental health that aren’t immediately obvious?

Getting Assistance From Benefits Coordinators

Benefits Coordinators specialize in helping employees understand their insurance plans. They can provide specific details about mental health coverage, including therapy. These coordinators often work closely with your insurance provider. They can assist with filing claims or understanding the necessary paperwork. This guidance can streamline the process, making it less daunting. Have you ever thought about setting up a meeting with your Benefits Coordinator? A short conversation might save you hours of confusion and ensure you get the support you need. Taking advantage of these resources within your organization not only empowers you but also ensures you make the most of your health benefits. When was the last time you checked in with HR or your Benefits Coordinator? It might be time to make that call.

Tips For Maximizing Therapy Benefits

Understanding your health insurance coverage for therapy can be confusing. Maximizing your therapy benefits requires some strategic steps. From choosing the right provider to reviewing your coverage, each action can make a significant impact.

Choosing The Right Provider

Not all therapists work with every insurance plan. Begin by checking the list of approved providers from your insurance company. This ensures your sessions are covered. Verify the therapist’s credentials and experience. A licensed provider often meets insurance requirements. Consider the therapist’s specialization. Choose someone who aligns with your needs. A good match enhances the effectiveness of therapy.

Regularly Reviewing Your Coverage

Insurance plans can change annually. Stay informed about your policy details. Review your coverage regularly. Check for changes in co-pays or session limits. Be aware of any new requirements for approval. This prevents unexpected expenses. Contact your insurance provider for detailed explanations. Clarity helps in planning your therapy sessions effectively.

Credit: www.careinsurance.com

Frequently Asked Questions

Does Health Insurance Typically Cover Therapy Sessions?

Health insurance often covers therapy, but specifics vary by plan. Check your policy’s mental health benefits section for details. Coverage may include certain types of therapy, like cognitive behavioral therapy. Always verify with your insurer to confirm what’s included and any associated costs or copayments.

How Can I Verify Therapy Coverage?

To verify therapy coverage, contact your insurance provider directly. Review your policy’s mental health benefits section. Ask about covered services, provider networks, and any potential limitations. You can also check online portals for detailed information. This ensures you understand your coverage before starting therapy.

Are There Limits On Therapy Coverage?

Yes, therapy coverage limits can exist in health insurance plans. These may include session caps, specific therapy types, or network restrictions. Always review your policy for these details. Contact your insurer for clarification and understand any out-of-pocket costs or requirements.

Do All Therapists Accept Insurance?

Not all therapists accept insurance, so check with your provider first. Some may be out-of-network, affecting costs. Verify with your insurer which therapists are covered. This helps you avoid unexpected expenses and ensures you’re utilizing your insurance benefits effectively.

Conclusion

Navigating health insurance can be tough. Therapy coverage is crucial for many. First, check your policy details. Call your insurance provider for clear information. Ask about co-pays, deductibles, and session limits. Consider using online tools for quick answers. Health insurance plans differ widely.

Understanding your benefits saves time and stress. Talk to your therapist about coverage options. They often know insurance procedures well. Being informed empowers your choices. Taking these steps can help you access the therapy you need. Your mental health matters.

Prioritize it by ensuring coverage is in place.

“As the voice behind Radiant Glow Health, we are dedicated to being your ultimate wellness and vitality companion. Our mission is to inspire and guide you on your journey to a healthier and more vibrant life. Join us as we explore holistic health practices and empower you to radiate wellness from within.”